Taxes

Business and Service Tax

Warwick Township has no business Privilege/Mercantile or Net Profits Taxes.

Earned Income Tax

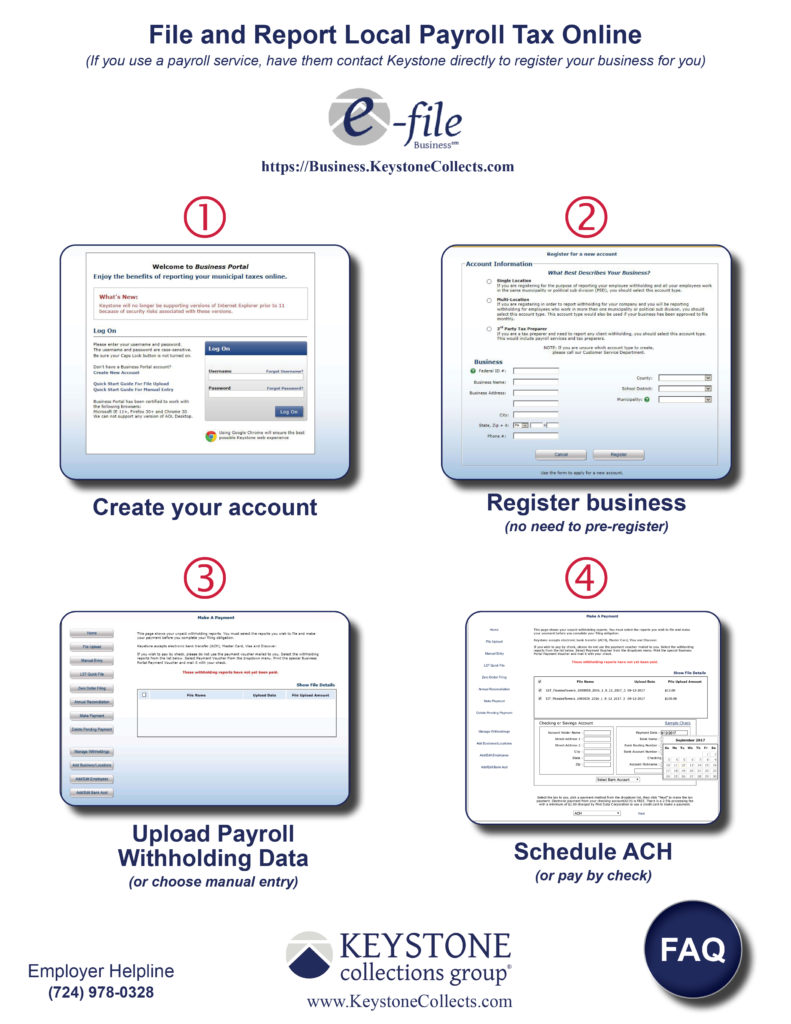

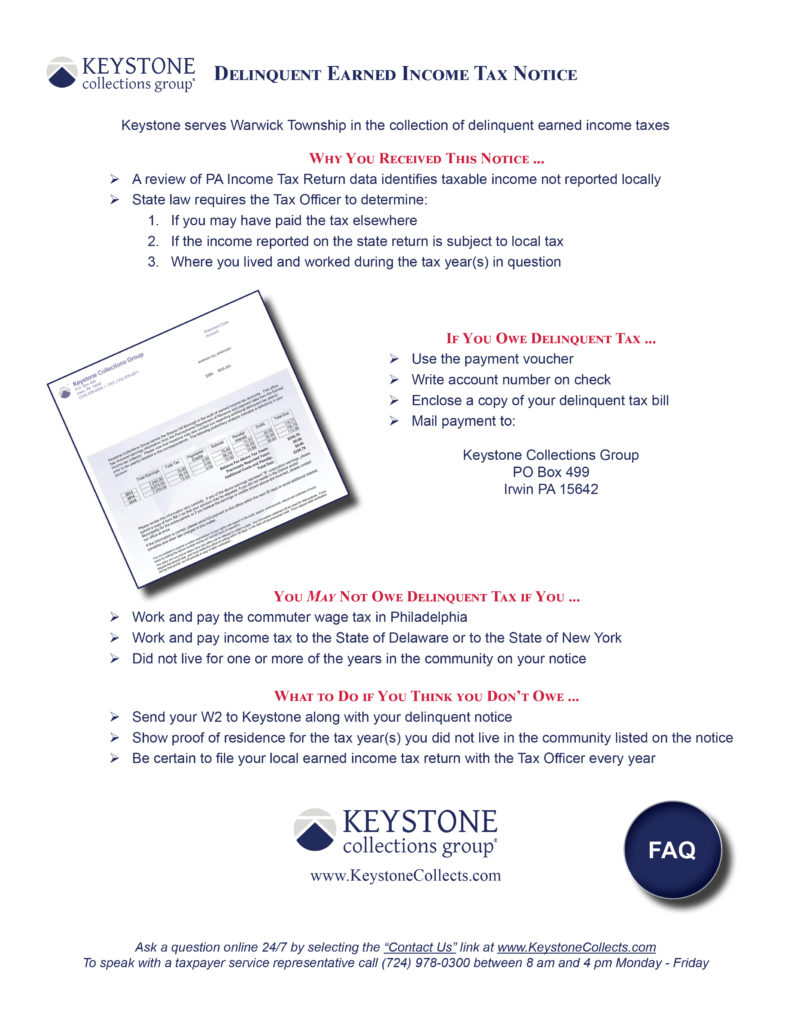

Keystone Collections Group is responsible for the collection of Earned Income Taxes. For more information, please visit the Keystone Collections Group website found here: https://www.keystonecollects.com/

Township and School Tax

Contact:

Denise Betts

Warwick Township Tax Collector

1733 Township Greene

Jamison, PA 18929

Phone: 215-491-0611

Fax: 215-491-4605

Email: warwicktaxbetts@aol.com

Website

Office Hours effective as of 3/1/16:

Monday through Thursday 9:00 AM to 12:00 PM.

Closed Friday and legal holidays. Any change in hours will be on voicemail and posted on office door.

Directions: Office is located in the Administration building, main floor. There is a dropbox available to deposit tax payments on the outside of the building to the right of the main entrance.

County & Municipal Taxes

County & municipal tax bills are mailed March 1st. A 2% discount is given if paid by April 30th, face amount if paid by June 30th, and a 10% penalty is enforced starting July 1st.

School Property Tax

School property tax bills are mailed July 1st, a 2% discount is given if paid by August 31st, face amount due if paid by October 31st, and 10% penalty is enforced starting November 1st. For the installment option, please check your tax bill.

- If a taxpayer has not paid county, school or municipal taxes by December 31st, the local tax collector files liens with the county. After February 1st, a lien fee and interest will apply.

Any change to a deed for any purpose causes the loss of your homestead exclusion and you must reapply with the County Board of Assessment.

Amusement Tax

A 5% tax is imposed upon admissions to places of amusement within the Township. Where no fixed admission is charged, the tax is based upon the gross admissions collected. Collection of the Amusement Tax is authorized by Part 2:600 of the Warwick Township Code #84-1 (Amended November 5, 2001: Ordinance No. 2001-07). The tax form and payment are due quarterly.